Charitable giving is typically linked to economic conditions, and 2022 was a tumultuous year. Russia’s invasion of Ukraine and China’s COVID-19 lockdown policies impacted economies around the globe. Stocks tumbled and inflation soared amid fears of a looming recession. How did these factors affect U.S. philanthropy?

Every January, Candid surveys large U.S. private and community foundations to understand recent grantmaking trends and forecast where giving is headed.i (See previous blogs from the 2022 and 2021 surveys.) The Foundation Giving Forecast Survey provides timely estimates and helps inform the Giving USA annual report on philanthropy.ii

This year, because we received so much rich information about foundations’ giving practices and priorities, we will share the findings in a three-part blog series. In this first blog, we outline what we learned about annual giving and payout in 2022.

Overall foundation giving from 2021 to 2022 increased by 3%

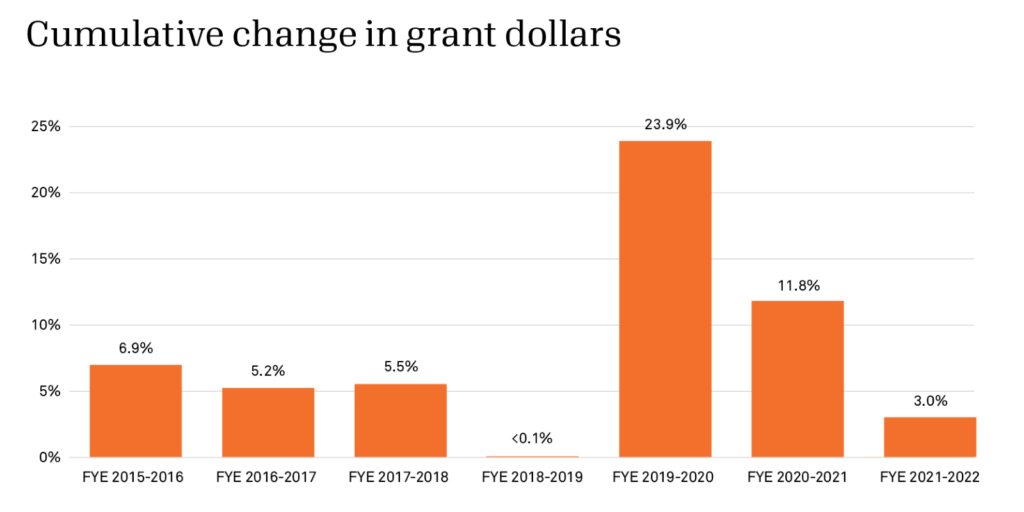

Among the 557 survey respondents who provided funding data for fiscal year end (FYE) 2021 and 2022, cumulative giving increased from $25.3 to $26.1 billion. This 3% increase in grant dollars is much lower than the 12% annual increase in 2021 and 24% increase in 2020 (all figures are unadjusted for inflation).

Rather, the 2023 change in giving more closely matches findings from survey data in pre-pandemic years. From 2015 to 2019, the annual change in grant dollars ranged from a high of 7% in 2017 to less than 0.1% in 2019.

Corporate foundations saw greater increases than independent and community foundations

Examining giving by foundation type, corporate foundations demonstrated the largest proportionate increase (nearly 12%) in grant dollars. In comparison, giving by community foundations rose 4%. Independent foundations, which account for most foundation grant dollars, also increased giving by less than 2%.

Community foundations accounted for $320 million (42%) of the overall $764 million increase in 2022 giving. Independent foundations accounted for 38% of the increase and corporate foundations, 20%.

Most foundations’ giving did not keep pace with inflation

The annual average inflation rate in 2022 was 8%, according to the Consumer Price Index. That means that foundations had to increase their grant dollars in 2022 by 8% simply to keep up with inflation. About 41% of foundations increased giving by at least 8%. The median foundation awarded 4% more grant dollars. (We will explore the impact of inflation on giving in our next blog in the series.)

Median payout by independent foundations in 2022 remained at 5.0%

Private foundations must generally meet an annual payout requirement of 5% of the average market value of their net investment assets. In 2022, the average payout among 349 independent foundations was 6.8%, similar to last year’s survey’s average. The median and mode were 5.0%.

Nearly half (48%) of independent foundations reported that their 2022 payout remained about the same as in 2021. Thirty percent reported that their payout increased. Reasons for increased payout included market performance and large one-time or multi-year grants. Interestingly, one foundation responded, “We are not as concerned about perpetuity as we used to be.”

The remaining 22% stated their payout decreased. A handful cited that they adjusted for higher payout in 2021 in response to the COVID-19 pandemic. This suggests that some foundations that increased payout during the pandemic reverted to “normal grantmaking patterns” afterward. Notably, among 77 foundations that decreased payout, 20 reported a payout of 6% or higher. Though these foundations’ payout decreased, they still gave at a rate above the legal minimum requirement.

More foundations expect their giving in 2023 to decrease than increase

Half of the foundations surveyed expect their giving in 2023 to remain about the same. But, for the first time in recent survey history, the proportion of foundations anticipating declines in giving (27%) exceeded those expecting increases (23%). This is a stark contrast to sentiments from previous years’ surveys in which, consistently, far more foundations were optimistic about their giving.

Respondents who expect to give more in 2023 cited increased assets, board-approved budget increases, establishment of new funds (within community foundations), multi-year commitments, and hope that the stock market will be less volatile this year. A few clarified that expected increases will be slight. Those who anticipate less giving attributed it to decreased endowment or asset value due to market conditions.

Foundations are sober about their giving this year, more so than in the past. Pandemic-level giving has slowed and has not kept pace with inflation. Yet, inflation has put pressure on nonprofit budgets and affected their ability to maintain services. Nonprofits will continue to need philanthropy to respond flexibly and generously to the needs of this moment.

Our thanks to the foundations that participated in this year’s Foundation Giving Forecast Survey. We conduct this survey annually and welcome feedback on what you’d like us to ask in 2024. Please share your ideas in the comments section. In future blogs, we will explore other insights from this year’s survey, specifically about inflation and general operating support.

i About the survey: From January through March 2023, Candid sent an online survey to roughly 2,500 of the largest U.S. private and community foundations by total giving. The survey focuses on large foundations because they account for the vast proportion of grant dollars awarded. In all, 602 funders responded: 421 independent foundations, 132 community foundations, 47 corporate foundations, and two operating foundations. All annual giving figures are based on the fiscal year end.

ii There are key differences in how survey data is analyzed in this blog compared to the Giving USA report. For example, Giving USA includes giving by corporate foundations in its corporate estimates rather than its foundation estimates. Giving USA also derives its foundation estimates from data sources beyond this survey.