Americans viewed inflation as the top problem facing the country in 2022. Individual donors specifically cited inflation as a major reason why they expected to give less last year. As a result, nonprofits were hit hard in multiple ways. Because of inflation, the value of dollars donated declined, while costs, wages, and for some, demand for services grew. With these challenges at play, how did inflation affect foundation giving decisions in 2022 and beyond?

Last month, Candid published results from the Foundation Giving Forecast Survey, an annual survey of large U.S. private and community foundations.i We found that cumulative giving grew by 3% in fiscal year end (FYE) 2022 compared to 2021, not nearly enough to keep pace with 8% average growth in inflation. We asked survey respondents if rising inflation impacted their foundations’ grantmaking decisions. Here’s what we found.

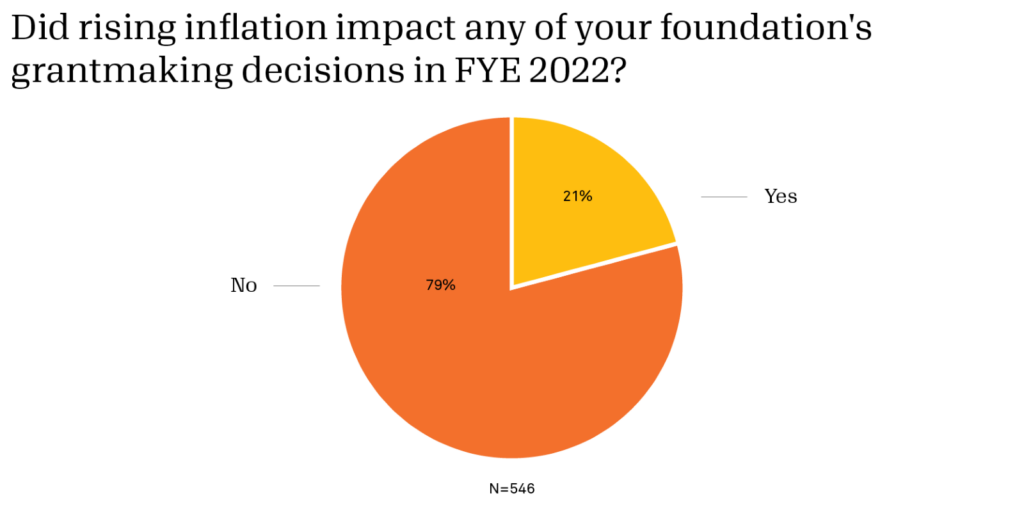

About one in five funders said inflation impacted 2022 grantmaking decisions

Of 546 survey respondents, 79% reported that inflation did not impact their grantmaking decisions in 2022. Several noted that their foundations’ grantmaking levels are based on the average market return of assets over multiple years, which smooths volatility. Others reaffirmed their foundation’s commitment to meeting giving targets despite economic conditions, as nonprofits still experience sustained needs and long-term impacts from the pandemic.

Twenty-one percent responded that inflation impacted their grantmaking decisions. Responses about how it affected giving last year were mixed—with inflation causing some foundations to give more and others to give less. Those who decreased giving primarily attributed it to a decline in their organizations’ asset value:

- “[Inflation] impacted the value of our investment assets which in turn impacted the dollar amount that we distributed.”

- “Due to economic conditions and indications of a recession, we saw a … decrease in annual giving.”

Among those who increased giving, here is a sample of their responses:

- “More need and granting from our non-endowed funds and donor-advised funds (DAFs.)”

- “We gave larger grants to long-term grant partners to cover their increased costs for the same programming.”

- “Program staff exercised flexibility to increase grant amounts because of inflation.”

- “We added 8% to each grant award.”

Inflation not only impacted giving dollars but also foundations’ giving strategies. For example, several foundations prioritized funding to address basic needs and reach communities most impacted by inflation:

- “Due to the rise in homelessness and food insecurity in our country, grantmaking did lean more toward basic needs.”

- “We opened our application process to any local nonprofit serving children and families.”

- “We gave more especially to underserved and low-income populations.”

Others reported that rising inflation caused them to consider more general operating support requests:

- “Inflation reinforced the need for us to grant flexible, general operating dollars instead of allocating to programs.”

- “We focused on operating and scholarship grants and less on capital grants.”

Slightly more funders anticipate that inflation will impact grantmaking decisions in 2023

When asked about grantmaking decisions in 2023, 29% of funders anticipated inflation would have an impact. Again, responses varied for how it would influence giving.

Respondents who anticipated decreased funding cited increased operational expenses, decreased asset value, and lower returns on investments:

- “Grantmaking will only be impacted insofar as it impacts the market.”

- “Our assets have gone down considerably, and we gave extra grants and funding during the pandemic, so double whammy to give few grants.”

- “To the extent that charitable administrative expenses are higher, they reduce the grantmaking budget.”

- “There is a high possibility that inflation will impact grantmaking from our donor advised funds as many fund values are down due to market turn.”

Survey respondents also acknowledged the toll inflation and rising costs have on grantees. They anticipated larger grantee budgets and funding requests due to inflation. Some expected to increase grant dollars awarded, whereas others considered how to re-prioritize funding:

- “There will be financial hardships for nonprofits, and we will need to find a way to help them.”

- “Since inflation impacts some of the nonprofits in our area more than others, we expect that our granting will shift towards those that are hardest hit.”

- “Goal to increase average grant size by 20% (will mean fewer grants)”

- “We have implemented inflation boost grants (~$20,000) for current grantees to offset unanticipated expenses.”

So far this year, inflation seems to be easing. Consumer price growth has slowed, but everyday costs remain high. The uncertain economic climate will continue to impact nonprofits and their staff, who are committed to meeting the needs of individuals and communities most affected by inflation.

Our thanks to the foundations that participated in this year’s Foundation Giving Forecast Survey. We conduct this survey annually and welcome feedback on what you’d like us to ask the field in 2024. Please share your ideas in the comment section below.

i About the survey: From January through March 2023, Candid sent an online survey to roughly 2,500 of the largest U.S. private and community foundations by total giving. The survey focuses on large foundations because they account for the vast proportion of grant dollars awarded. In all, 602 funders responded: 421 independent foundations, 132 community foundations, 47 corporate foundations, and two operating foundations. Annual giving figures and survey responses are based on the fiscal year end.