The impact of matching gift programs on nonprofit organizations is undeniable. Recent matching gift reports indicate that 84% of donors are more likely to donate if a match is offered, while 1 in 3 would give a larger gift if matching is applied.

But if you want to take a look at the specific ways corporate matching benefits your institution—and have the data you need to justify investing in workplace giving further—a smart matching gift reporting strategy is essential.

At its core, matching gift reporting involves the systematic tracking and analysis of metrics related to your organization’s matching gift fundraising efforts.

This data can encompass various aspects, from the number of match-eligible donors identified to the total revenue collected through the programs and beyond.

And in this guide, we’ll walk you through everything you need to know to begin making the most of your matching gift metrics. This includes:

Ready to get reporting? Let’s dive in with the basics of why matching gift metrics matter in the first place.

The Critical Value of Matching Gift Reporting

According to research from Nonprofits Source, 73% of firms aspire to be data-driven in their fundraising efforts—but only 29% of firms actually succeed at turning data into action. When it comes to your nonprofit’s matching gifts initiatives, you want to ensure your team falls into the latter category.

After all, a data-driven fundraising strategy informed by your organization’s matching gift metrics can go a long way in empowering your team to better…

Analyze donor behaviors and identify emerging trends

Analyze donor behaviors and identify emerging trends- Predict future matching gift fundraising outcomes

- Target initiatives according to segmented groups

- Optimize communication channels for engagement

- Measure the impact of your matching gift campaigns

- Track matching gift success year over year

- Establish realistic fundraising goals

- And more!

So if your organization is accepting matching gifts without collecting and analyzing the data each transaction produces, you’re likely missing out on a ton of valuable insights.

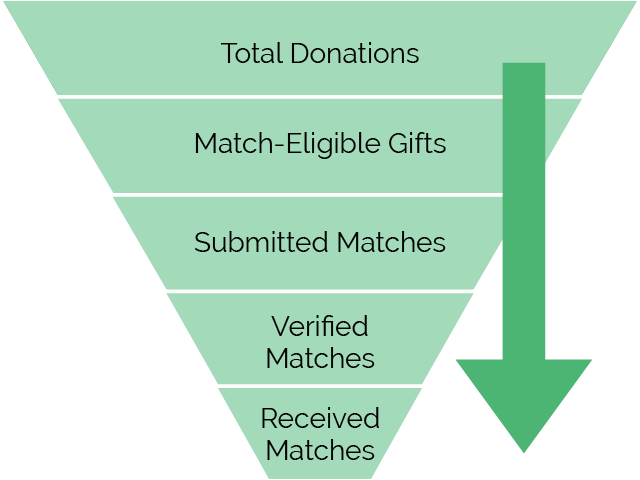

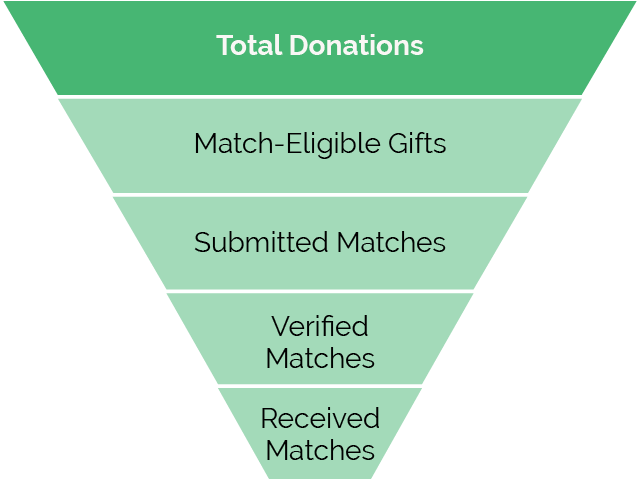

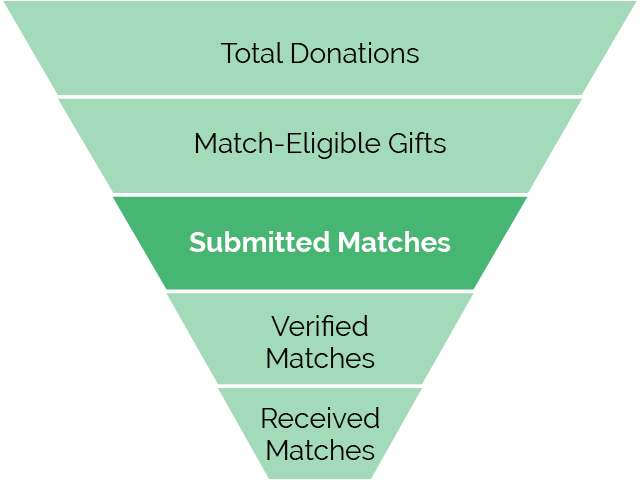

Tracking Matching Gifts Through the Conversion Funnel

Of all the donations an organization receives, only a small portion (approximately 1.31% at an average nonprofit) are typically matched by the donors’ employers. But around ten times that amount generally qualifies for corporate matching opportunities.

In order to uncover where the discrepancy comes in, you’ll want to have a system in place for tracking matches as they progress through the matching gift process.

At any point in time, you should be able to determine how many gifts are at each stage in the conversion funnel—and those totals are some of your simplest matching gift metrics, to begin with!

Total Individual Donations

First off, knowing how many total donations your nonprofit receives on a monthly, quarterly, and yearly basis will help your organization going forward. When you have an indication of your regular donation flow, you’ll be better prepared to measure your matching gift success proportionally.

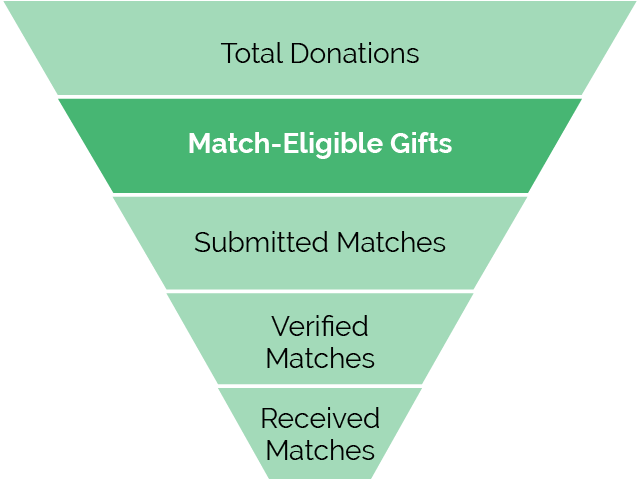

Total Donations Flagged as Match Eligible

Out of the donations that you’ve already received, you might know which companies your donors work for based on the employment information you collect during the giving process.

Use this data to determine which of your donors are eligible to have their donations matched—either by conducting manual research or by scanning your information against a matching gift database like Double the Donation.

While it is unlikely that all of your matching-gift-eligible donors are doubling their donations, your nonprofit can benefit by knowing what percentage of your total donations have the potential to be matched by their employers. And you’ll know that these are the donors you’ll want to focus your matching gift efforts on!

Total Matching Gifts Submitted

While you might want to jump into measuring the matching gifts your nonprofit receives, it’s worthwhile to first determine how many requests your donors are actually submitting.

Unfortunately, you might find that you aren’t getting all of the matched donations that your donors are requesting.

This gap may boil down to:

- Matching gift deadlines not being met.

- Donors having previously reached their annual maximums.

- Your organization falling into an ineligible recipient category.

- Any other corporate stipulations.

While your nonprofit can’t do much to shift the specific matching gift criteria that companies set up, it can help you adjust your marketing strategy going forward. For example, if you see that many of your donors’ match submission windows were closed by the time your team began pushing to encourage requests, you can make a note to start driving match submissions immediately after an initial gift is made going forward.

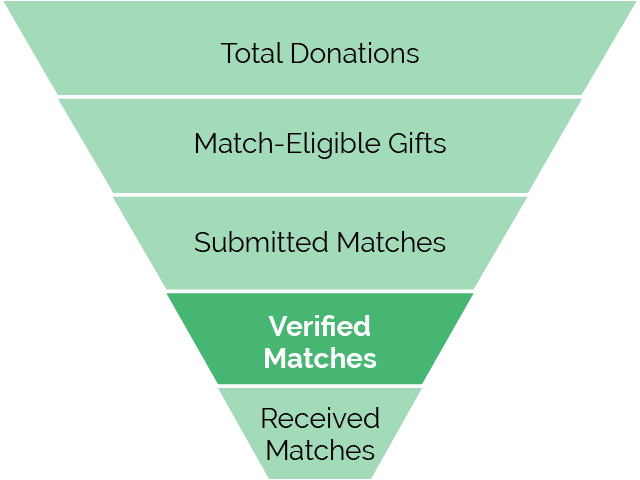

Total Matching Gifts Verified

Before disbursing the money from a matching gift donation, many companies that offer these programs require that an organization verifies that it received the employee’s initial gift in the first place. This typically involves logging into a CSR platform and confirming the transaction.

If you are only verifying a portion of the matching gift donations that your donors indicated having submitted, then you could be missing out big time. Keeping track of this metric can be useful for filling in those gaps and uncovering “hidden” matches.

However, it’s important to note that, with the continuous development of the matching gift process through auto-submission and other innovative functionality, many donations are able to skip ahead of this step with no further action needed.

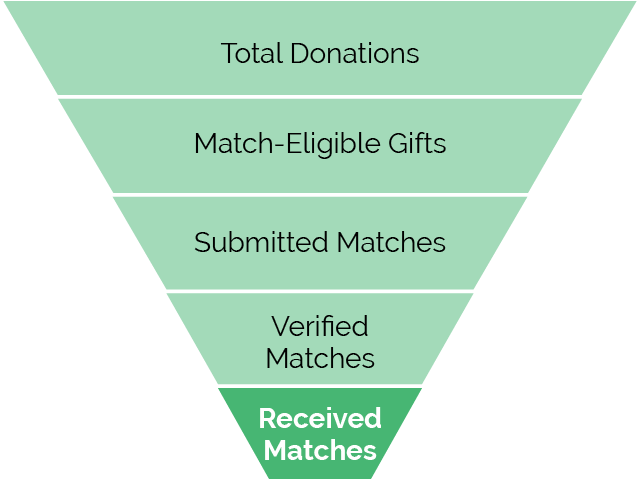

Total Matching Gifts Received

Finally, this vital metric tracks the matching gifts you actually receive.

Once the corresponding corporate donation makes its way to your organization’s bank account, you can mark it off as “Match Completed!”

Top tip: Upon calculating the total number of donations that fall into each of the specified categories, you’ll want to hold onto this number. It will be used to calculate other metrics below!

8 Matching Gift Metrics Every Nonprofit Should Monitor

Beyond the status of individual matching gifts, your matching gift coordinator or development team should take a look at these recommended metrics as well.

Remember: the metrics you establish as your highest priority will then become your KPIs (or Key Performance Indicators) for defining matching gift success. We recommend trying to track the most actionable information—and then have a plan for how you’ll use the information you collect to increase your matching gift revenue!

Total Number (and Value) of Matching Gifts

The first matching gift metric represents the combined count (and, subsequently, monetary value) of all matching gifts received within a specific period.

If you’ve been tracking your matches through the conversion funnel demonstrated above, this number will be comprised of all the gifts that made it to the bottom tier. From there, calculate the monetary value by adding the sum values of each matched donation.

Ex: Match 1 Value ($50) + Match 2 Value ($40) + Match 3 Value ($200) + Match 4 Value ($500) + Match 5 Value ($1,000)…

# of Matching Gifts = 5

$ Value of Matching Gifts = $1,790

These figures provide an overview of the scale of your organization’s matching gift participation and the potential impact on your fundraising efforts.

Matching Gift Eligibility Rate

While it’s good to know how many matching gift donations your nonprofit receives, it’s equally important to put that number into perspective. To do so, your eligibility rate gauges the percentage of donors in your database who are marked as eligible for corporate matching gift programs through their employers.

Calculate this figure by dividing your match-eligible donor count by the total number of individual donors, then multiply by 100 to receive your percentage.

Ex: (Match 1 + Match 2 + Match 3) ÷ (Match 1 + Match 2 + Match 3 + Ineligible Gift 1 + Ineligible Gift 2 + Ineligible Gift 3 + Ineligible Gift 4 + Ineligible Gift 5) = 37.5%

Matching Gift Completion Rate

Next, this metric reveals the percentage of eligible donors who successfully complete the matching gift process—ultimately resulting in your organization receiving a corporate match.

To calculate, simply divide the number of completed matches by the total number of eligible donors, then multiply by 100.

Ex: (Match 1 + Match 2 + Match 3) ÷ (Eligible Gift 1 + Eligible Gift 2 + Eligible Gift 3 + Eligible Gift 4 + Eligible Gift 5) = 60%

The donors included in the not completed side of things represent your untapped potential and can help inform your strategies to encourage more donors to leverage matching gifts.

Unfortunately, it can be tricky to track this figure accurately because matches are often fulfilled according to different disbursement schedules throughout the year. But that’s why top automation software allows you to more easily follow matches through the process and determine when donors initiated and verified their matches.

Average Matching Gift Amount

This figure can help quantify the mean value of the matching gift donations you receive. And to calculate, you’ll be going back to your Total Number of Matching Gifts and Total Value of Matching Gifts from Step #1—and dividing the latter by the former.

Ex: $50 + $40 + $200 + $500 + $1,000 (Value of completed matches) ÷ 5 (Number of completed matches) = $358

Understanding the average dollar amount of a matching gift for your organization can help quantify the value of your matching gift fundraising efforts. Plus, it can provide insight into the level of donors typically engaging with your matching gift program.

For example, if you brought in 50 matching gifts, but each one was only worth around $10, that’s still an extra $500 for your organization. But you may need to start targeting your larger givers and encourage them to look into matching gift programs as well!

The higher your matching gift average amount comes out to be, the more major donors have likely participated in their employers’ match initiatives for your cause.

Revenue Increase Due to Matching Gifts

For this metric, your organization will determine the increase in total fundraising revenue that came about through matching gifts.

To calculate, begin by subtracting the value of your completed matching gift donations from your total fundraising revenue (including matching gifts).

Then, divide your total matching gift revenue by the total revenue without matching gifts to determine the percentage increase that your fundraising grew.

Ex: Total fundraising revenue ($15,000) – Matching gift revenue ($2,000) = Revenue without matching gifts ($13,000)

Matching gift revenue ($2,000) ÷ Revenue without matching gifts ($13,000) x 100 = 15.4%

This figure quantifies the additional funds raised due to matching gift programs, emphasizing the impact on your overall revenue—and, thus, your mission.

Matching Gift Retention Rate

Your organization’s matching gift retention rate is defined as the percentage of donors who complete a matching gift on your behalf in one year and then repeat the action in the next year.

To calculate this figure, you’ll need to determine the number of matching gift donors who had their gifts matched in the most recent time period that also had their gifts matched in the period before. So you’ll need to have been focused on matching gift reporting for at least two years (or other pre-determined time periods) in order to establish this number.

To do so, divide the number of donors who made repeat matching gift contributions by the total number of matching gift donors from a previous period. Then, multiply by 100.

Ex: Repeat matching gifts from this year (Match 1 + Match 3 + Match 4) ÷ Matching gifts from last year (Match 1 + Match 2 + Match 3 + Match 4 + Match 5) = 60%

Like any retention-focused metric, your matching gift retention rate assesses the effectiveness of your strategies in retaining donors who participate in matching gift programs year after year. Remember: it’s always the hardest the first time around!

Growth in Matching Gifts Over Time

Another helpful figure that you can explore after you’ve been tracking other matching gift metrics for some time is your rate of growth.

You can calculate growth in matching gifts over time by subtracting the previous period’s total matching gift value from the current period’s value. Divide the result by the previous period’s value, then multiply by 100.

Ex: Current period’s matching gift total ($3,500) – Previous period’s matching gift total ($2,000) = YOY increase ($1,500)

YOY increase ($2,000) ÷ Previous period’s matching gift total ($2,000) x 100 = 75% YOY growth

Recording this particular metric over time helps your nonprofit see the increases in matching gifts as they relate to your overall fundraising. As you get more established in your marketing and promotional efforts, your audience will become more familiar with the opportunity, and you can expect to see your matching gift results continue to trend upwards.

Matching Gift Fundraising ROI

Matching gifts are an excellent source of fundraising revenue for nonprofits. But, as they say, it costs money to make money. And though matching gifts are essentially free “bonus” donations contributed by donors’ employers to match their own charitable efforts, it does involve some investment of your organization’s time and resources to pursue. Thus, your matching gift fundraising ROI assesses the return on investment for your matching gift efforts.

To calculate, simply subtract the cost of managing and promoting the opportunity to your donors from the total revenue generated through matching gifts. Divide the result by the initial cost, then multiply by 100.

Ex: [Revenue generated from matching gifts ($10,000) – Initial cost of matching gift fundraising ($1,000)] ÷ Total cost ($1,000) x 100 = 900%

This figure helps evaluate the efficiency of your program in generating additional funds and can also help make the case for investing further into the revenue source—such as with a dedicated software.

Key Insights Gleaned From Matching Gift Analytics

Analytics takes your data a few steps further than basic metrics and can, in turn, provide your fundraising team with some particularly useful (and actionable!) findings. Specifically, matching gift analytics is the aspect of reporting that help uncover underlying trends, patterns, and recommendations.

To fully unleash your organization’s matching gift potential, analyzing the data produced through your efforts to glean key insights is essential.

We suggest exploring the following recommended benchmarks.

Optimal Match Communication Timing

The timing of your matching gift appeals is key. In fact, it’s often the difference between a donor taking the next steps to submit a matching gift and your email going unnoticed in their cluttered inbox.

By taking note of the times when your audience seems most receptive to matching gift communications, you can use the data collected through your reporting strategy to adjust your timing accordingly.

For example, studies based on Double the Donation data report that matching gift emails sent anytime within the first 24 hours of a donation being made results in a 53% open rate—or 2.6 times higher than the average nonprofit email open rate. But if you notice that your audience tends to respond particularly well to match reminders sent immediately post-donation, feel free to trigger automated follow-ups within minutes.

Not to mention, tracking matching gift responses over months and years can help identify longer-term timing strategies as well.

For instance, if you notice that you receive more matching gifts after your year-end appeals have been made, take a look at the matching gift marketing strategies you used leading up to December 31st. If you aren’t already, implement those tactics for your fundraising all year round for greater matching gift success.

Matching Gift Conversions by Marketing Channel

Like timing, the communication channels you use to promote matching gifts to your donors can make a huge difference. And focusing your resources where conversions are highest can enhance your ability to effectively communicate the opportunity and drive action.

For example, if you notice that your email click rate is lower than average, you might want to take another look at the matching gift emails you’re sending. Is it coming from your nonprofit’s own domain and branded to match your existing communications style? That’s a must for establishing a sense of trust and familiarity with your supporters.

On the other hand, if you suspect that your matching gift emails are just getting lost in donors’ inboxes, you might want to explore other messaging channels—like SMS.

High-Value Match Opportunities in Your Database

An automated approach to matching gifts can save your fundraising team loads of time and effort. But when it comes to some of your highest-value opportunities, you might want to make a more personalized effort to engage about matching gifts. So you should have an easy way to identify these types of gems from within your donor base!

First, determine what defines a “high-value” matching gift opportunity. Perhaps it’s a major donor who works for a company with a particularly high annual matching cap. Though it may be a mid-level donor whose employer offers an extremely generous triple—or even quadruple—match.

By identifying donors whose matching gifts can bring you significant amounts of revenue, you can prioritize engagement accordingly. You may decide to pick up the phone, send a handwritten letter, or even meet face-to-face with some of these high-value matching prospects.

Leading Business Affiliations within Your Network

Similar to the standout individuals in your support network, you may have a few companies that match their employees’ gifts to your organization. Thus, your leading business affiliations are the companies that employ particularly large segments of your donor base.

This insight can help inform broader partnership-building strategies with businesses that align with your mission, even beyond your typical matching gifts. And remember: your donors, who may work for some of the most philanthropically-minded companies, can be some of your greatest advocates!

Driving Results With Matching Gift Reporting Tools

Now that you know what information to track and the types of insights you can pull, what can you actually do to get started?

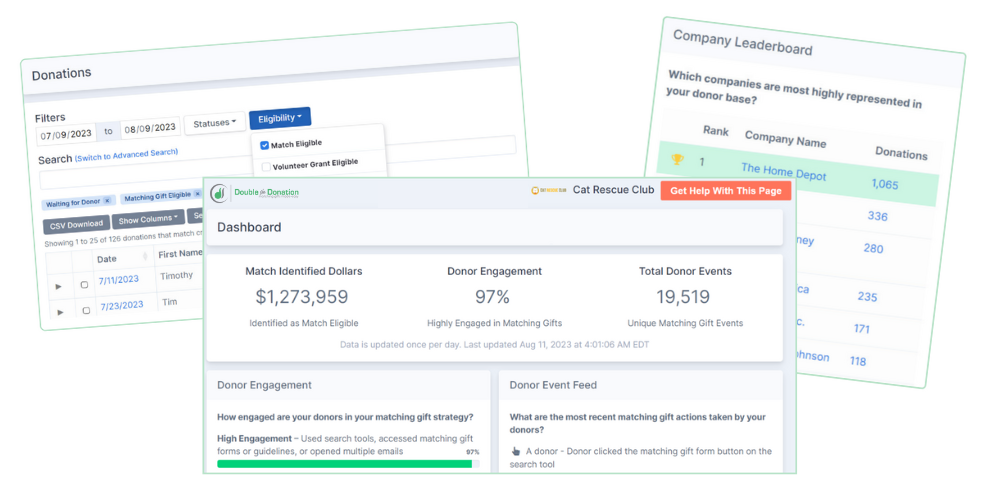

If you don’t want to perform all the calculations by hand (and trust us: you don’t), equipping your team with the best tools for effective matching gift reporting is a must. And that means Double the Donation’s 360MatchPro—the industry-leading matching gift automation platform.

Matching Gift Reporting With 360MatchPro

360MatchPro streamlines the entire matching gift process by automatically identifying and triggering personalized outreach to eligible donors and tracking their matches from start to finish.

Along the way, it also utilizes your data to analyze trends, provide targeted recommendations, and produce user-friendly reports that present your findings in an easy-to-understand way.

Pre-built reports within the platform include:

- Top companies leaderboard with recommended actions for pursuing broader corporate giving goals

- Match-eligible donations leaderboard that displays the match-eligible donations with the highest matching gift potential

- “Ripe for the picking” eligible but not submitted view that filters for donors marked as match-eligible with an online form available but have not yet submitted their match request

- Repeat matching gift filter that pulls a list of donors who previously had their gifts matched but currently have an un-submitted match in the system

- Campaign Comparisons report that easily compares highest-earning time-boxed fundraising campaigns in terms of matching gift eligibility

- Missed Matches reports that highlight recent transactions that may be match-eligible, despite being marked otherwise or skipped over in email outreach

- Key statistics, such as total emails delivered, open and click rate, match revenue identified per month, total match revenue identified, matching gift engagement level, total donor events, and more

- Breakdown of current match statuses, including Waiting for Donor, Match Initiated, Pending Payment, Match Complete, Unknown Employer, and Ineligible

Additionally, 360MatchPro users can customize different views in their “Donations” tab, choosing to configure lists of recent donations according to match eligibility, request status, and more.

Next Steps

Data produced within the matching gift process is one of your most valuable assets—but you need to have a system in place for tracking, storing, and analyzing the information you collect.

Get with your team to determine which matching gift metrics best represent your organization and its fundraising goals. While each of the above-mentioned analytics can provide invaluable insights as they guide and inform your matching gift marketing initiatives, consider centering your reporting strategy on one or two points to get started.

From there, establish a plan to track appropriate data, conduct an analysis of the information you’ve gathered, and continue to adjust your overarching plan as needed.

Keep learning! Grow your knowledge of all things matching gifts with these additional recommended resources: